Saida loan app is a product of Greenshoe Capital Inc. it serves as a money-lending app that provides unsecured instant loans to users through their phones. You can rely on it to sort out emergencies (personal or business-related) whenever you are cash-strapped. This article will explore everything you need to know about the Saida loan app. From the application, requirements, borrowing criteria, rates, repayment process, contact, you name it.

First, let’s start with, how does the Saida loan app work? And what better way to figure that out than downloading the app.

Getting the app

- Head over to Google Playstore, search and download Saida loan app, or get the Saida loan app apk on their webste. Unfortunately, it is not available on iOS.

- Launch the app to get started with loan application.

Requirements/Eligibility

- You should have an Android phone

- You must be at least 18 years old and have a valid National ID

- You must be a Safaricom or an Airtel subscriber

- You should have a good credit score

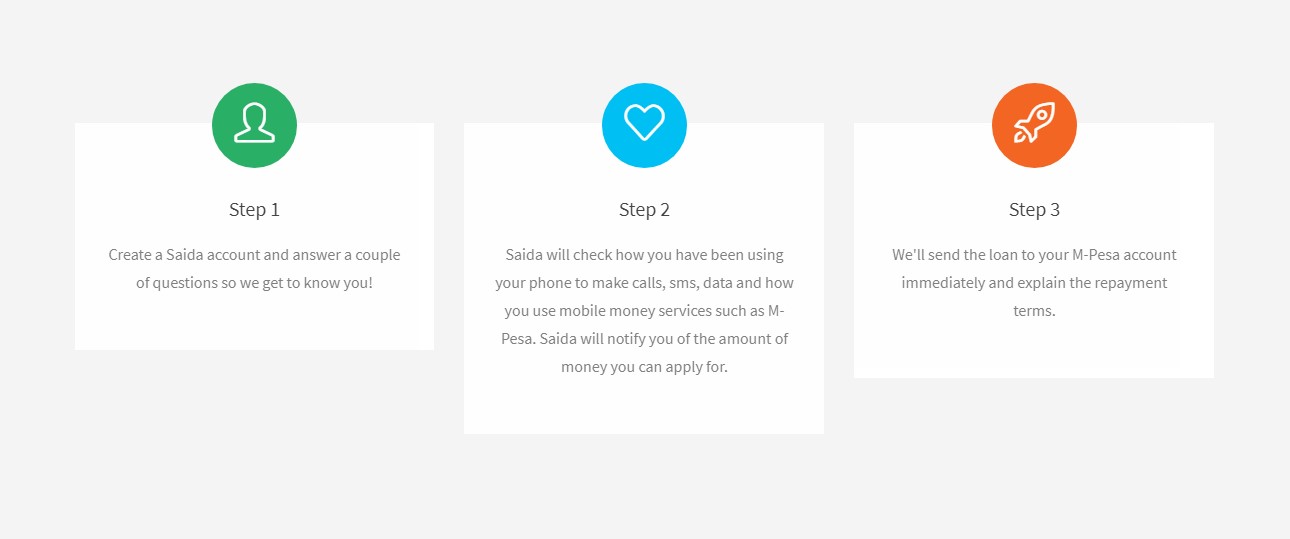

How to Register for Saida Loans

- Open the Saida app

- A welcome screen will open up. Read and swipe through the guidelines and select “Get Started” at the end.

- You can now start creating your Saida account.

- The first information needed will be your registered phone number.

- Those with more than one phone number should consider using the one with the most money transfer and banking record transactions. It will help them score high loan limits.

- Next, you will be required to record your personal details such as full name, ID number, email address, etc.

- Saida uses this information to create your profile. They will then collect mobile data from your phone and use it to determine the amount of money they can offer you a loan.

- Once the registration is successful, you will be taken to Saida’s homepage where you can confirm your loan eligibility

- You will be asked to provide more information before the loan limit is availed

- Answer the questions truthfully.

- The loan limits range from a minimum of 600 to a maximum 0f 25,000. Those approved will have to select the amount of time they will take to pay the entire amount.

- You have the option of paying the entire amount after 1 month or in small installments stretched within that period. Users can also request for an extension of the repayment period to a maximum of 6 months.

- In case your request is not approved, Saida always gives a reason for the denial. You could be requested to upload more data.

- The final process is accepting the terms and conditions.

- The money will be sent straight to your M-pesa account

The Rates and Loan Terms

Saida loan interest rates vary from one customer to the next. The rates are personalized depending on a variety of factors. For instance, high-risk individuals get charged high rates. Low-risk clients can get rates that are as low as 7.5%. Apart from a one-time debt collection fee that may be charged if your loan is late by 35 days, you won’t be charged for late fees.

You can check out other mobile loan apps or options here for comparison.

Repaying Your Saida Loan

To clear your Saida loan on M-pesa, use the paybill number 854400 and follow these instructions

- Open sim toolkit on your phone and select Safaricom

- Launch M-pesa

- Choose the “Paybill” option and enter 854400 as the business number

- Click OK

- Enter your phone number as your account number

- Type the repayment amount and click OK

- Lastly, enter your M-pesa pin to confirm the transaction and complete your Saida loan payment

There are no penalties when you pay early. In fact, early payment will improve your credit score, which in turn leads to higher loan limits.

Other Saida Services

Apart from lending money to users, the app can also be used for savings services, bill payment, and phone insurance cover too.

Saida Loan App Review

On Playstore, Saida loan app has a 3.9 star review out of 5. Most of the reviews are positive since a good percentage of the 500,000+ people who have downloaded the app are pleased with its performance. Nevertheless, there are negative reviews too.

Conclusion

For more details about the app, you can get Saida loans contacts directly on the application, their website, or social media. Feel free to ask them anything about their services. They are always happy to help out their customers.