Filing tax returns is a statutory requirement for all citizens of age and non-residents in Kenya. This is a declaration of income earned by an individual in a particular financial year and each individual with a KRA pin is required by law to file their annual returns.

The taxman normally offers a window between 1st January and June 30 of the year to file tax returns. The taxman exclusively reserves this process to be done strictly on its online platform. Significant changes and implementation of the iTax system has seen the fast and easy filling of returns nationwide since its inception in 2014.

Requirements for filing your KRA returns

All you need is access to the internet, an existing email address, your password, and KRA issued PIN. If you are employed you need to have your employers PIN or you with file KRA returns using P9 forms. Other relevant financial documents like mortgage certificate, insurance premiums certificate, and tax withholding certificates are also needed for the process in addition to deduction claims and income received. That notwithstanding, several people still have difficulties filing returns even enlisting 3rd parties at a fee to file their returns especially if your company doesn’t file KRA returns for employees. Well worry not here is a comprehensive guide to filing your KRA returns.

How to File Your KRA Tax Returns on Online

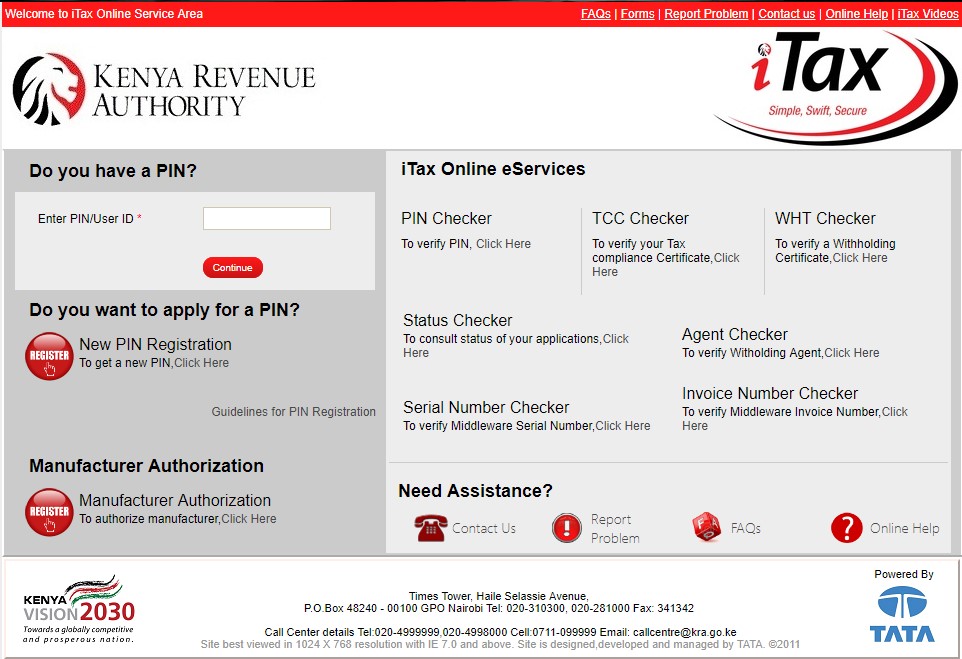

- Follow this link to the iTax portal

- Login in using your PIN and click continue to bring the password page. Enter the password.

- Press the login button (answer the security question verifying your identity and ownership of your online KRA account).

- Scroll to the navigation bar, and choose e-returns, several options will appear.

- Scroll downward and select “file returns” (This page contains information on the different types of taxes people pay)

- Pick the right Tax application. Go to the next page.

- The next page usually contains information on the filling process a download link to the KRA file returns form.

- Click to Download this form (normally in tow formats Excel or ODS format) and open it.

- The tax-returns form has empty fields that are required to be filled with your details as accurately as possible

- Fill in all the required details accurately.

- Next, save the document on your device ( as a zip file ).

- Return to the” file returns” page on the online KRA portal.

- Choose the period covered in the returns you have filed.

- Upload the saved document on the “file returns “page on the portal.

- Agree on the terms and conditions by checking the empty box.

- Click on submit options to automatically send your document to the taxman.

- The KRA iTax system will authenticate the details entered like your PIN and particulars before sending a confirmatory message acknowledging the complete filing of returns.

At times due to human error or system overload, there may be delays or error message during the authentification. In this case, you may have to go back and enter your details afresh(If you have entered the wrong pin) or wait( if the system is taking long to send a confirmatory message).

System delays are normally attributed to filing overload during registration deadline dates where the number of people filing returns shoots up. However, those who file prior to the deadline rarely encounter system delays and should successfully complete filing returns in minutes as long as there is a stable and reliable internet connection to your device.

This is the procedure you can use to file KRA returns if not employed or employed. There is a different procedure for filing NIL KRA returns when not employed.