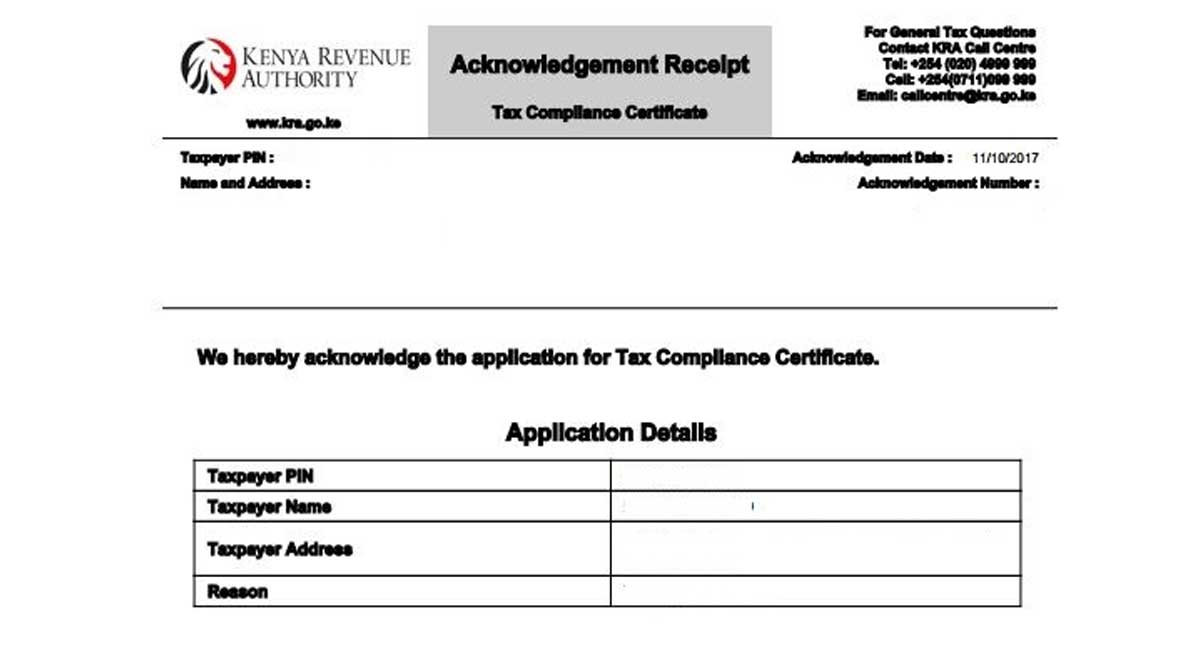

A tax clearance certificate is issued by KRA as proof of paying to file and paying all your taxes. This document is usually issued by the taxman upon application. The document is usually valid for 12 months. The application process is done using the iTax platform and lodged 7 days before the expiry of an ..