A tax clearance certificate is issued by KRA as proof of paying to file and paying all your taxes. This document is usually issued by the taxman upon application. The document is usually valid for 12 months. The application process is done using the iTax platform and lodged 7 days before the expiry of an existing TCC.

Why TCC?

For individuals engaging in various business activities and services, a TCC is important e.g. tenderpreneurs, employees, liquor licenses, clearing and forwarding agents amongst others.

Requirements before applying for TCC

- Payment of tax on or before the due date.

- Clearance of all outstanding tax debt.

- Filing of tax returns on or before the due date for all applicable tax obligations

Application Guide for Tax Complaint Certificate (TCC)

- Go to KRA iTax portal

- Enter your PIN and Password

- Complete the security question

- Go to the menu and click on “certificates”

- Select Tax compliance Certificate option

- You will be redirected to another page

- Fill in the dialogue box with an explanation as to why you need a TCC

- Click the submit button

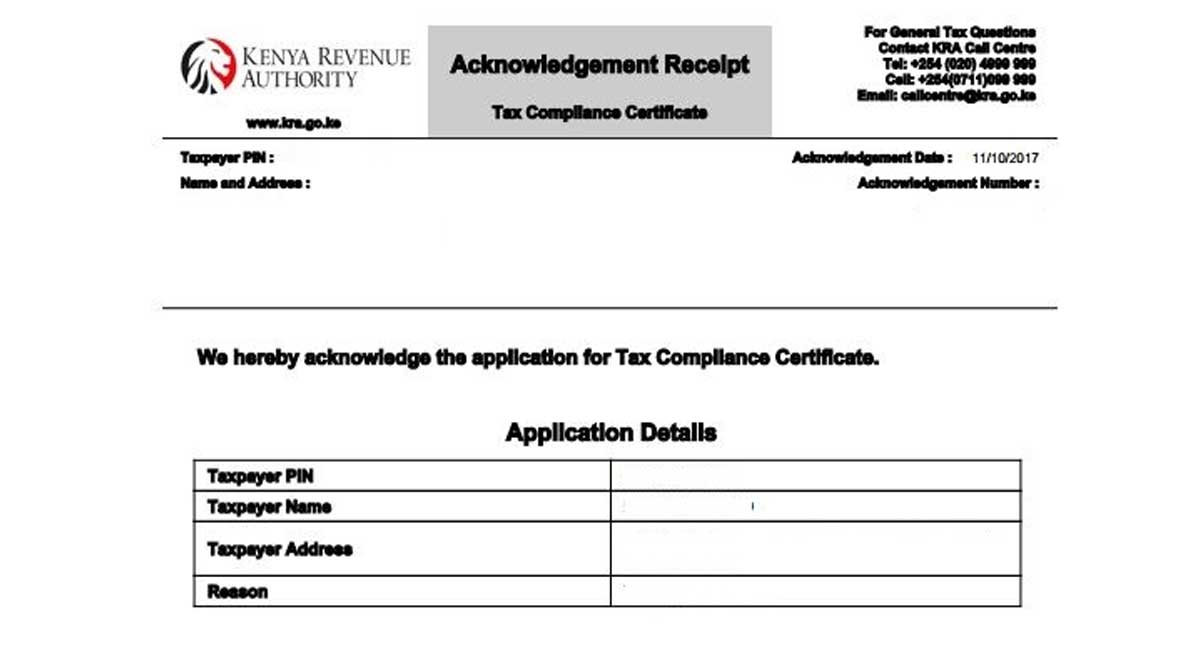

- You will receive an email from KRA detailing your request

- Wait for five working days to receive a TCC (This is if you have no issues with your tax obligations).

- An email will be sent to you of the TCC

- Download the image of TCC and print it.

This is a simple guide on how to apply for Tax Compliance Certificate Kenya. Pay attention to various key dates especially if you are an employee (your employer should file your PAYEE by 9th of each month) if you offer services or sell goods, (file your income tax every 20th of the month). As you can see the process is expeditious. In case of any complications, you can click on the help tab on iTax.