You are not a true Kenyan unless you wait until the last minute to file your tax returns. Most Kenyans also do not bother to master how to file returns using P9 form.

Here are the steps to file KRA tax returns using p9 form;

- Log in to your iTax account

- Click on the Returns option

- Click on the ITR for employment Income only

- Then click on the Download file option

- Download the PAYE excel sheet

- The sheet downloads in a zipped folder

- Extract the excel sheet

- Fill in your details as is necessary

- Enter the Return period and select yes if you have employment income

- Answer the questions asked under the basic information section and click on next

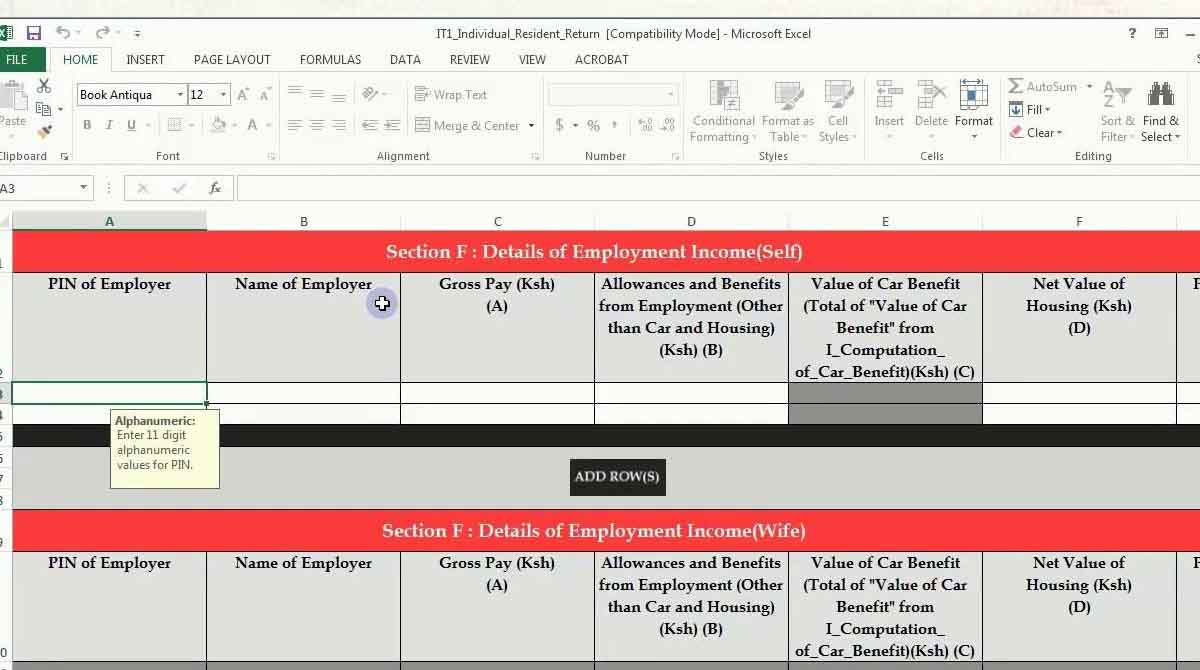

- Go to section F and fill in your employment income details

- Confirm your employer’s name and PIN number

- Make sure you input the correct gross pay and allowances as per your P9 form

- Go to sheet M and key in details of your PAYE deducted, confirm your employer’s details, taxable salary, and PAYE deducted

- If any payments were made recently capture those details in section Q

- Once you are done, generate the output file by clicking on the Validate button on the very last page

- Save the zip file generated on your machine

- Then go back to your iTax account and upload the file

- Check the terms and conditions

- Click on the submit button

- The system will generate a returns receipt if your file was filled correctly

- You will receive a notification email from KRA stating that they have successfully filed your returns

Summary on how to use P9 form to file KRA returns

If you do not fill your KRA returns correctly, you will get an error message when you try to upload your tax returns. You will have to go back to the excel sheet and fix the errors, then validate the sheet again for it to generate a new file.

Check this also: How to get P9 form from GHRIS